Broad market coverage

Serving in key markets like Nigeria, Ghana, Kenya, and Gambia with resilient payment infrastructure.

Simplified onboarding

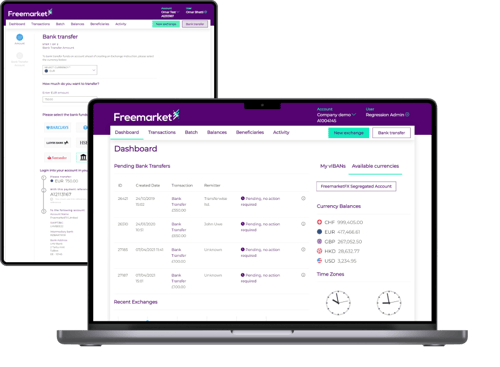

One contract, one platform, one integration—your clients can start sending money quickly.

Multi-currency capabilities

Effortlessly manage multi-currency payments with seamless access to vIBANs and cross-border transfers.

Helping MSBs connect families across borders

At Freemarket, we recognise the crucial role MSBs play in supporting families and communities across borders. Every transaction is more than just a money transfer—it's a lifeline, a promise and a connection to loved ones.

To help you strengthen these vital connections, we provide tailored solutions that cut through the complexities of cross-border payments. Our platform guarantees fast, secure transactions for your clients, while streamlining multi-currency management and supporting the growth of your MSB into new markets.

Multiple currencies

Our solution, accessible via a single API, allows you to execute and manage payments across more than 31 currencies and markets with real-time pricing. Simplify your cross-border transactions with ease and flexibility.

Multiple banking partners

Our platform is custom-built to bolster your growth across borders. Connected to a network of tier-1 banks, NBFIs and fintechs, Freemarket allows you to diversify your product offering and overcome the challenges of narrow risk appetites. Resilience is key.

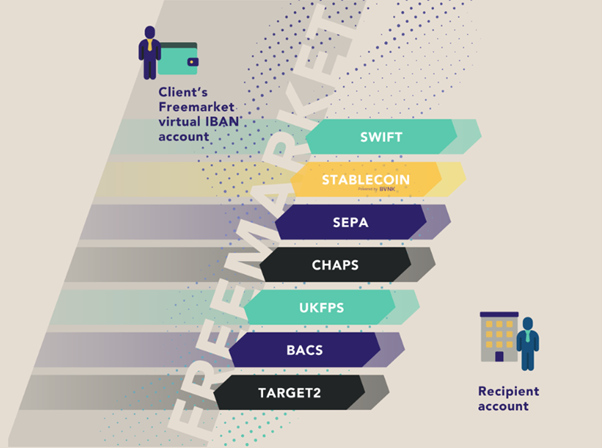

Multiple payment rails

Experience the freedom to choose the best payment rails for your business. With Freemarket, access a variety of payment rails and effortlessly switch between them - all in one platform.

Expert insights

.png?width=700&height=700&name=Untitled%20design%20(4).png)

"Africa continues to be one of the fastest growing regions for remittances, and saw annual growth of 1.9% through 2023 to $54 billion. Yet, despite these increases in volumes, the payment infrastructure remains fragmented, inconsistent, and volatile. With long transaction times, high fees and inconsistent service across borders, MSBs are forced to rely on a patchwork of providers to efficiently move money to the region.

Freemarket's streamlined payment rails and multi-currency support overcome these infrastructure challenges, providing faster, more cost-effective solutions. Additionally, as regulatory environments in markets like Nigeria and Kenya evolve, we ensure compliance while positioning ourselves for future growth in the rapidly expanding remittance market.

At Freemarket, we support some of the fastest growing African-MSBs fuel remittances across markets like Nigeria, Ghana, and Kenya. We’re here to help you simplify payments and reduce costs."

- James Gable, Business Development Director