In operation since 2014, Freemarket works with businesses globally to accelerate their growth by giving them access to cross-border payments and currency exchange optimised for their treasury and operational needs—streamline processes, remove complexity and increase efficiency. With our platform, corporates can unlock more currencies and markets for their business through a single, API-enabled connection point. Combining service aggregation and integrated technology, we make it faster and easier for businesses to move money around the world. By accessing our global banking network, you can pay in, exchange currency and pay out anywhere in the world.

Watch our short intro video to learn more.

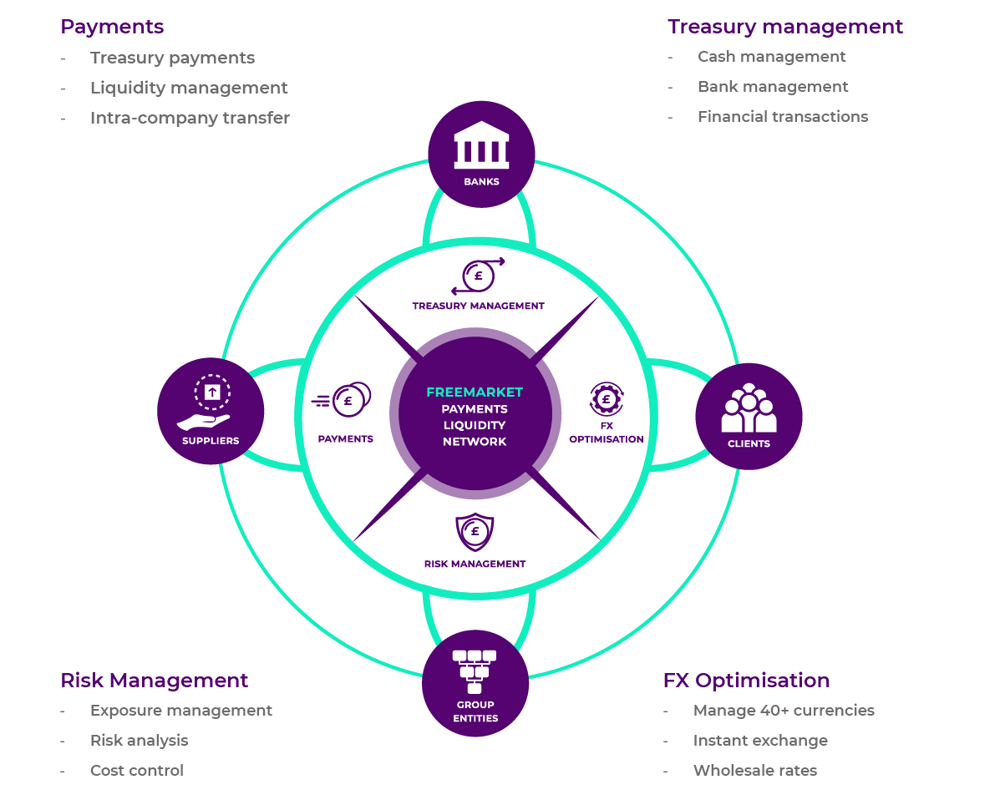

Freemarket Liquidity Network

Connect your business to our network of global banks and payment system providers to optimise

treasury, risk, bank payments and working capital.